Products

Income Protection

What Type of Life Insurance is Right For you?

Buying life insurance to protect your family’s future may require you to make some important choices, including the type of life insurance you need. If you’re a first-time life insurance shopper, chances are you may not know which option may be the right one for you. Below is a breakdown of various life insurance options to help you find the best match.

Term Life insurance

Term life insurance has level premiums that last for a set number of years (the term). This life insurance includes a death benefit in the form of a lump sum of cash that’s paid out to a beneficiary by the life insurance company if you die while this coverage is active. This lump sum can be used for a variety of things, such as burial expenses, mortgage, and debt payments, living expenses for your family, or donations, generally tax-free. Additionally, you may have the option to convert your policy to permanent coverage before the term ends. After the term expires the policy may either terminate or automatically renew annually. If your policy is at the end of the term period, then you may be able to renew it for another term or convert it to a permanent policy.

Key features of the policy

- It provides a generally tax-free death benefit for your loved ones.

- Easy-to-understand.

- Typically, low-cost life insurance.

Who should buy it?

Term life insurance is a great choice for many people because it’s simple and cost-effective. If you’re on a tight budget, or you’re a young person age 20-30 who is just starting to build your financial future, term life insurance can be a good match for you.

Term Life insurance

Term life insurance has level premiums that last for a set number of years (the term). This life insurance includes a death benefit in the form of a lump sum of cash that’s paid out to a beneficiary by the life insurance company if you die while this coverage is active. This lump sum can be used for a variety of things, such as burial expenses, mortgage, and debt payments, living expenses for your family, or donations, generally tax-free. Additionally, you may have the option to convert your policy to permanent coverage before the term ends. After the term expires the policy may either terminate or automatically renew annually. If your policy is at the end of the term period, then you may be able to renew it for another term or convert it to a permanent policy.

Key features of the policy

- It provides a generally tax-free death benefit for your loved ones.

- Easy-to-understand.

- Typically, low-cost life insurance.

Who should buy it?

Term life insurance is a great choice for many people because it’s simple and cost-effective. If you’re on a tight budget, or you’re a young person age 20-30 who is just starting to build your financial future, term life insurance can be a good match for you.

Guaranteed Universal Life Insurance

Guaranteed universal life insurance is permanent coverage that provides the ability to guarantee a death benefit to any age up to a maximum as stated in the policy, as long as premiums are paid and the policy remains in force. Guaranteed universal life insurance generally is not designed to build up cash value.

Key features of the policy

- Can provide a guaranteed death benefit for your whole life.

- Death benefit passes to beneficiaries generally tax-free.

Who should buy it?

Anyone with a need for death benefit coverage who desires to buy a policy that can cover their entire life with less costly premiums compared to other permanent products.

Indexed Universal Life Insurance

Indexed Universal Life is insurance offers death benefit protection, and the opportunity to earn tax-deferred interest on the interest credits linked to the performance of one or more stock market indices chosen. This feature gives you the potential for cash value accumulation plus, it offers downside protection in a poorly performing market because you do not participate directly in the stock market and the credited interest rate is never less than the minimum interest rate or zero percent (floor). The upside is limited by either an index cap rate or an index participation rate. The index cap rate is the maximum interest rate that could be credited to the policy. The index participation rate is applied to the index change in order to calculate the index credit. The premium paid in the policy is not directly invested in any index or the stock market.

Key features of the policy

- The death benefit is not generally subject to income taxes for the beneficiary.

- It offers the potential to grow cash value.

- The amount credited to the cash value grows tax-deferred without directly investing in the market.

- Flexible, adjustable premium, and death benefit amounts as needs change.

- It can be an expensive product depending on your goals.

Who should buy it?

If interested in providing a death benefit for your beneficiaries with additional benefits, an indexed universal life insurance policy might be attractive to you for its upside growth potential and downside protection.

Indexed Universal Life Insurance

Indexed Universal Life is insurance offers death benefit protection, and the opportunity to earn tax-deferred interest on the interest credits linked to the performance of one or more stock market indices chosen. This feature gives you the potential for cash value accumulation plus, it offers downside protection in a poorly performing market because you do not participate directly in the stock market and the credited interest rate is never less than the minimum interest rate or zero percent (floor). The upside is limited by either an index cap rate or an index participation rate. The index cap rate is the maximum interest rate that could be credited to the policy. The index participation rate is applied to the index change in order to calculate the index credit. The premium paid in the policy is not directly invested in any index or the stock market.

Key features of the policy

- The death benefit is not generally subject to income taxes for the beneficiary.

- It offers the potential to grow cash value.

- The amount credited to the cash value grows tax-deferred without directly investing in the market.

- Flexible, adjustable premium, and death benefit amounts as needs change.

- It can be an expensive product depending on your goals.

Who should buy it?

If interested in providing a death benefit for your beneficiaries with additional benefits, an indexed universal life insurance policy might be attractive to you for its upside growth potential and downside protection.

Final Expense

Final Expense are the end-of-life costs an individual incurs shortly before and shortly after they die. That could include final medical bills and funeral costs. Some life insurance policies can be used to cover final expenses for the people the now-deceased individual leaves behind. There are two categories of Final Expense coverage: Guaranteed issue, and Simplified issue. With Guaranteed Issue you can’t be turned down for health reasons, there are no medical questions and no exam. It’s guaranteed acceptance, pure and simple.

Simplified Issue Final Expense (SIFE) insurance is a whole life insurance policy that has a small death benefit. Frequently, SIFE insurance is commonly referred to as “funeral insurance,” or “burial insurance” and is a small whole life policy with a death benefit of $5,000 to $50,000.

What is the difference between final expense and life insurance? Final expense is a type of whole life insurance and usually has a smaller face amount than traditional insurance. It focuses on covering end-of-life expenses while most life insurance policies focus on income replacement.

Key features of the policy

- Final expense insurance policies allow you to select a beneficiary. You can choose an agent who’s legally responsible for the allocation of benefits. Or you can designate a partner or relative to act as a beneficiary to ensure instructions are followed and funds are properly distributed. No medical exam required.

- Final expense insurance is designed to provide your loved ones with cash to cover expenses associated with your burial, funeral and medical expenses.

- In some cases, a percentage of the death claims can be paid within 24-48 hours without a death certificate.

Who should buy it?

Final expense insurance is a life insurance policy that has a lower death benefit, usually intended to cover final expenses and burial costs. Also known as burial insurance or funeral insurance, it’s designed for older adults who are ready to make end-of-life plans, typically age 50 and older.

Annuities

Annuity Contract

Annuity Contracts are created when an individual gives a life insurance company money which may grow on a tax-deferred basis and then can be distributed back to the owner in several ways. The defining characteristic of all annuity contracts is the option for a guaranteed distribution of income to the persons named in the contract for some period certain like 10 and 20 years’ or until the death of the person. However, the majority of modern annuity customers use annuities only to accumulate funds and to take lump-sum withdrawals without using the guaranteed-income-for-life feature (or annuitized).

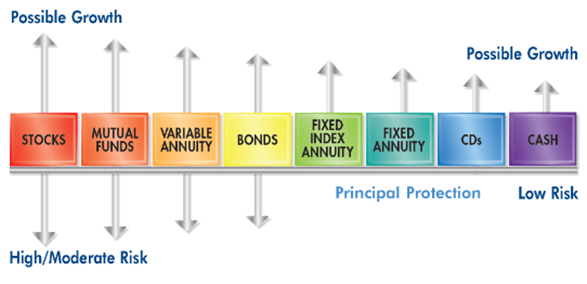

What are the difference types of annuities?

Fixed Annuities

Fixed Annuities, the insurance company guarantees the principal and a minimum rate of interest. The fixed annuity will grow and will not drop in value. The growth of the annuity value and/or the benefits paid may be fixed at a dollar amount or by an interest rate. Investors can find annuities with a set interest rate that lasts for a number of years. During the distribution phase, fixed annuities produce a regular fixed payment that don’t change in amount.

Fixed Indexed Annuities (FIA’s)

Fixed Indexed Annuities are tax-deferred, stable, financial option designed to grow your premium and protect it if the market drops. This product is typically accompanied with multiple crediting strategies that you can choose to participate in. These crediting strategies include at least one indexed account and may also include a Fixed Rate account. When you select an indexing strategy, you are credited interest at the end of the crediting period in the event the index value grows.

A Fixed Indexed Annuity offers access to more interest growth potential as the market performs positively. In addition to growth potential, a Fixed Indexed Annuity offers protection of principal in several different ways. You do not lose money, including interest earned during previous crediting periods, if the index value drops because your money is allocated to the annuity itself rather than directly to the index (or indices). Additionally, the indexed accounts typically offer a minimum guaranteed interest rate of at least 0%.

Variable Annuities

Variable Annuities are invested in a fund like a mutual fund, but only open to investors in the insurance company’s variable life insurance and/or variable annuities. The fund has a particular investment objective, and the value of your money in a variable annuity and the amount of money to be paid out to you is determined by the investment performance (net of expenses) of that fund. Most variable annuities are structured to offer investors many different fund alternatives. You put money in, you select the funds, and you hope over time it grows. Variable annuities are regulated by state insurance departments and the federal Securities and Exchange Commission.

Do you know you RISK TOLERANCE? Note how each Saving Vehicle works!

Deferred Annuities

Deferred Annuities receive premiums during the accumulation phase and the investment changes to a payout phase at a later time (called distribution phase) when the account is annuitized. The payout might be a very long time; deferred annuities are used for retirement purposes and can remain in the deferred stage for decades during your working years.

Immediate Annuities

Immediate Annuities sometimes called a Single Premium Immediate Annuity is designed to pay an income one time-period after the immediate annuity is bought. The time period depends on how often the income is to be paid. For example, if the income is monthly, the first payment comes one month after the immediate annuity is bought. Other options could include an annual payment like a check received once a year.

Retirement Rollover

Rollover your old Qualified Plan into a IRA

A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan.

Advantages

- Your investment will remain tax-deferred until you withdraw them

- You will have access to wide range of investment options

- You may have the flexibility to convert to a Roth IRA

- You may be able to take penalty-free withdrawals prior to age 59½ in a special circumstance (such as higher education expenses, health insurance premiums or a first-time home purchase)

- You will have access to a wide range of tools, resources, and services

Disadvantages

- You will not be able to take a loan against your account

- You may not have access to the exact same investments in an IRA that you had in your plan

- Any outstanding plan loan balances would need to be repaid prior to rolling over or you may incur income taxes and potentially a 10% tax penalty

- If you hold appreciated employer stock in your former employer’s plan account, there may be tax consequences. You should consult with a tax advisor

- The level of protection from creditors for assets in an IRA is lower than in a plan

College Planning

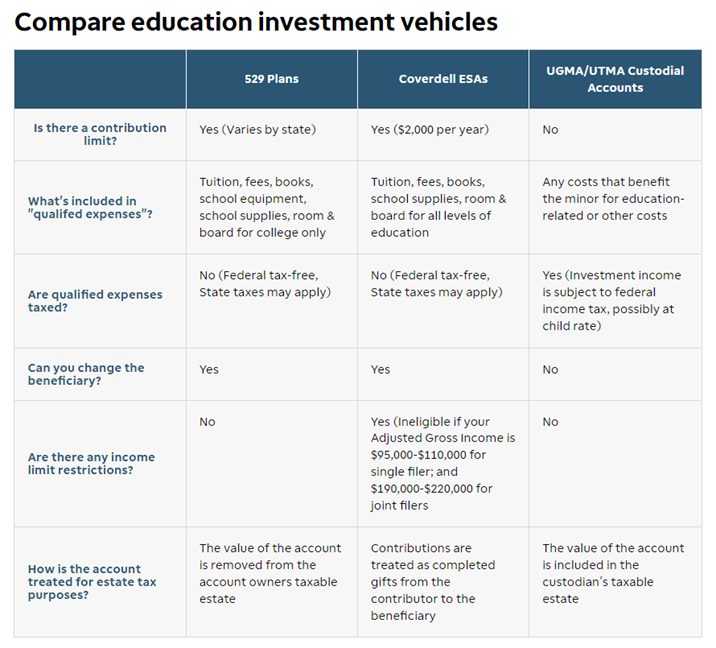

Investment vehicles designed for education

There are a number of choices available for those seeking tax-efficient accounts specific education. These include 529 college saving plans, Coverdell Education Saving accounts, and UGMA/UTMA Custodial accounts.

529 plans

Sponsored by individual states, these college saving plans offer a level of flexibility and potential tax advantages that can make them a great choice for the right investor. Benefits of a 529 plan vary from state to state

529 preplan tuition plans

Some states offer an alternate 529 plan that allows you to prepay tomorrow’s college tuition at today’s prices to attend an in-state college. Some plans cover tuition, fees, and room and board, while others only cover tuition and fees.

Coverdell education saving accounts

These accounts offer federal tax-free earnings and withdrawals on qualified expenses such as tuition, books, computers, and room & board. While 529 plans are used exclusively for college. Coverdell Education Saving Accounts (ESAs) can be used for elementary and secondary schooling in addition to college. Additionally, there are no minimum contributions, and the account owner can contribute up to $2,000 per child per year.

UGMA/UTMA custodial accounts

Custodial accounts provide a way to build assets for your children or loved ones’ future, and let you manage a minor’s assets for their benefit. As you build a portfolio, with or without assets from the minor, you will be the guardian of the account, managing it until the minor reaches the age of majority. From the start, the account will be held under the minor’s name and social number. Once they are old enough they will assume control of all assets.

See chart below:

Personal Cashflow Plan

Follow These Steps to Personal Financial Success

- Acquire as much cashflow as possible each month. Business income, less taxes, W-4 adjustment, less expenses and eliminated debt. Apply the extra cashflow to step in the system.

- Set up a beginner’s emergency fund. You need $5,000 in the fund. You may want to put the money into a money market account or a municipal bond fund instead of a regular checking account or savings account. Also, you should keep the emergency fund separate from your regular checking account. If necessary, make periodic deposits until you get to $5,000 and then stop. If you already have $5,000, move it to your emergency fund account, separate from your other funds. Do not go to steps 3 until you complete steps 2.

- Begin investing in a retirement account of some kind (401-K, 403-B, IRA, Roth IRA, Simple IRA, SEP IRA, Annuity). If you can, put in the maximum amount 10%, on a monthly basis, but at least 5% of your income. Do not go to step 4 until you have completed step 3.

- Take the rest of your available cashflow (after living expenses) and set up the LUSFG Debt Elimination Plan. Pay off all your consumer debt (not your mortgage) while improving your credit score (Goal: 750-850 / See “myCredit System” in the services tab). Do not go to step 5 until you have completed step 4.

- If you are not maxing out your retirement investment, raise payments to the max (step 3). Do not go to step 6 until you complete step 5.

- Take all of your available monthly cashflow and build a full emergency fund. The fund should be built to six to twelve months living expenses. Building the emergency fund to six to twelve months living expenses should happen fairly quickly because you have extra cashflow acquired from less taxes, less debt, less expenses and business income. Do not go to step 7 until you have completed step 6.

- A – If you are renting, buy a home and proceed to 7B. If you are buying a home, got to step 7B.

B – Take the available cashflow and pay off the mortgage. Do not go to step 8 until you have completed step 7. - Start building an investment portfolio account over and above your retirement accounts. You have endless options: Stocks, Bonds, Real Estate, Mutual Funds, ETF’s, Annuities etc. You should have extra cash by the time you get to this step. Also, your financial knowledge should have increased.

- Consider protecting steps 1-8 by protecting your most valuable asset, “YOUR INCOME”! (See “Income Protection” tab) Do not go through steps 1 – 8 overlooking your most important asset!